“SRI 2.0” is Not What You Think – You Really Can Have it All

A lot of folks think all we do is get rid of oil companies and invest in solar, but responsible investing is much more than that. Once known as Socially Responsible Investing, SRI has gotten both broader and deeper as it evolved into Sustainable, Responsible, and Impact Investing. There is a long and meaningful history dating back to the 18th century when Quakers prohibited members from participating in the slave trade. Basic “do no harm” tenets quickly evolved over the years as religious investors were advised to also avoid “sinful” companies that produced products such as guns, liquor, and tobacco.

In the 1960s & 70s, broad change around equality for women, civil rights, and labor issues began to influence the SRI movement. Well-intended, yes, but at the time, this new and different type of investment strategy that aligned your investments with your values was viewed as radical ‘hippy-dippy nonsense’ by most and it lacked the proven track record of many historically good performers.

But today, in 2021, that’s simply not the case anymore.

What is now “Sustainable, Responsible, and Impact Investing” accounts for more than $12 trillion in assets under management yearly. Yet still, many people view it as a fleeting fad, too difficult, and an investment strategy that can’t possibly produce market competitive returns.

So, what has changed?

As evidenced by the evolving acronym definition, a lot has changed. Most notably, (1) better evaluation data and metrics as well as (2) a broader range of companies and investment options.

But what does this mean for you, the investor?

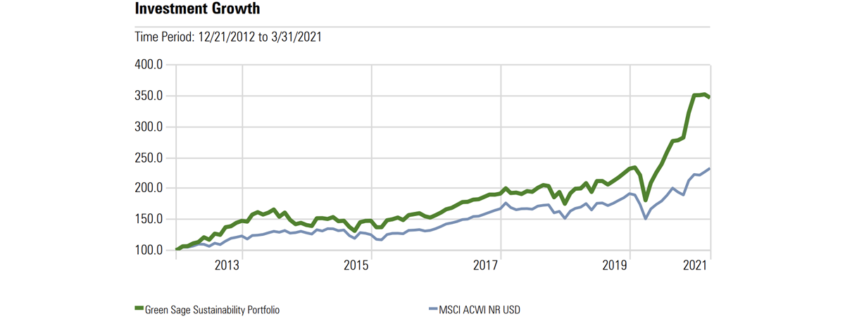

It means that today, you actually can have it all – a portfolio that aligns with your values and market competitive returns.

Welcome to “SRI 2.0”

- Better SRI evaluation criteria and metrics:

What used to be a big-picture-only evaluation, with companies being excluded from an SRI portfolio based solely on their core business or products produced, is now much more granular to include both internal and external business practices. Environmental governance, for example, was not part of “SRI 1.0,” but as the focus on carbon pollution has increased, so too has the importance being placed on its reporting in the corporate sector – giving us the ability to weigh in not only with our voices, but more consequentially … our dollars.

While there is still no universal evaluation standard, companies today are typically ranked on rigorous financial performance and non-financial metrics such as whether or not they’re involved with agricultural chemicals, the use of animal testing, and the percentage of renewable energy used. - Broader range of companies and investment options:

With the increasing importance being placed on responsible and sustainable business practices comes more companies that are actively trying to meet the “SRI 2.0” standards. And with more choices comes better investment options, as well as the more recent ability to tailor your entire investment portfolio around your values while still maintaining a balanced and diversified portfolio.

As many larger investment firms move into the SRI space, they tend to focus on larger companies and often on companies found in major stock indices. However, there are many new opportunities in smaller companies capitalizing on societal shifts such as plant-based foods, sustainable farming, and EV charging. We keep a close watch on this ever-expanding universe of companies, because as it grows … so do the sustainable investment opportunities.

Your Money Can Do More

With more publicly-traded companies with deeper value propositions, you can have competitive returns and the peace of mind that comes with deep-values alignment. “SRI 2.0” does not limit your impact, but rather … amplifies it. Simply put, in today’s investing landscape, you can have it all.

As one of the Southeast’s first SRI-only investment firms, and with the broadest access to rigorously screened sustainable, responsible, and impact investing opportunities, Earth Equity is poised to cultivate and empower a community of all generations to grow personal wealth and make a positive impact for our planet, our society, and our future. Learn more about Sustainable, Responsible, and Impact Investing in SRI 101.